Special (subsidised) interest rate offers for equipment purchases

Date

04 July 2024

Share

Special interest rates are usually offered as part of a subsidy agreement between the machinery supplier and the financier. This subsidy aims to make the purchase of the dealer stock more appealing by offering a lower interest rate. What is less transparent, is that the finance cost is then carried by the dealer, and therefore needs to be recovered in the machine sale price.

What are special interest rates?

Special (subsidised) interest rate offers for equipment purchases have become increasingly popular in recent years. In a slowing market or when there is a significant excess of equipment, suppliers may use a special interest rate strategy as a way to clear out their stock. These offers often appear very attractive, with interest rates appearing much lower than standard asset finance rates. However, it is important to recognise that these special interest rates are not free. Within the finance industry these are commonly known as either “dealer subsidised rates” or “blind-discount rates”.

A special interest rate vs. full price purchase

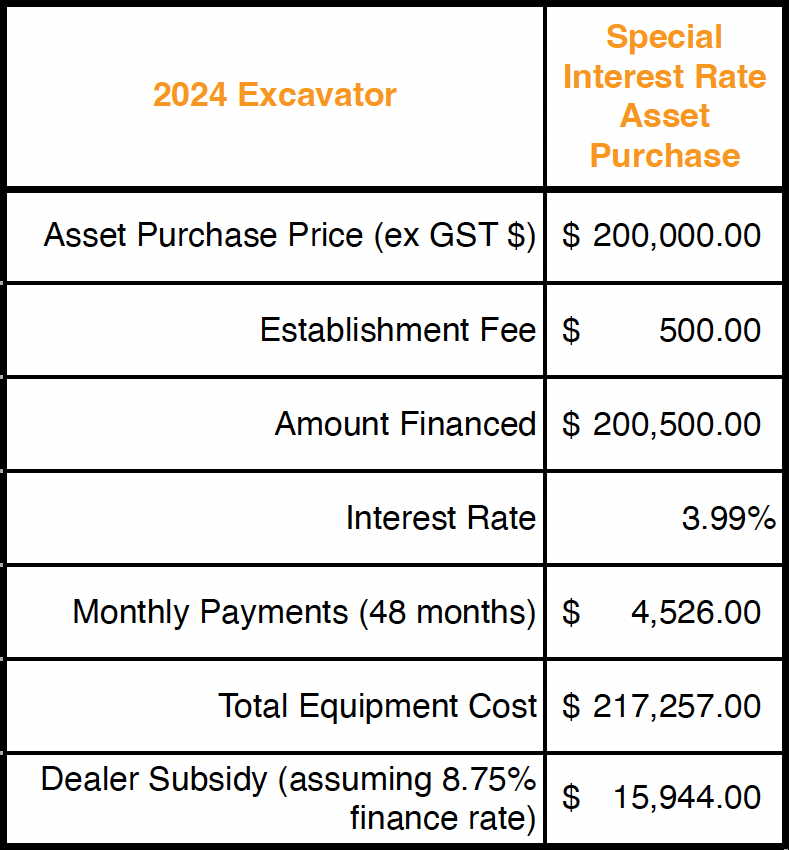

By offering lower interest rates, suppliers can attract customers without having to reduce the full retail price of the equipment. This allows the dealer to maintain the perceived value of their machinery in the market, while making the purchase appear more attractive to customers at face value. If you purchase equipment with a low interest rate offer you may still pay the full interest cost, but in a different way. Let's break it down using the example below.

In the above scenario, to subsidise the interest rate from a market interest rate of say 8.75% (48-month fixed rate) to a 3.99% “special rate, the supplier would be paying the finance company a subsidy of just under $16,000. If you are in the market for a new piece of equipment or a vehicle it is a wise idea to check the cash price even if the finance rate is low. Savvy buyers should be able to negotiate this discount off the asset sale price. Some dealers may increase the sticker price of their machinery to offset the interest subsidy they must pay.

Special interest rate loan terms and structures

Special interest rate structures commonly have shorter loan terms, deposit requirements, or balloon payments, all of which can impact cash flow. These loan structures are often designed to reduce the amount of subsidy required. The shorter the term and the larger the deposit, the smaller the subsidy. This can create cash flow pressure for the borrower. This finance is not cheap if you’re carrying the consequences of fast repayments on your overdraft. Unlike most equipment suppliers, our advisers are experienced and qualified finance professionals and experts in our industry. Instead of just offering a one-time finance solution for your equipment, our finance experts can show ways to reduce interest costs and maximise cash flow efficiency to meet your financial needs now and in the future.

Making changes to your loan

Finance obtained through supplier-based financing can have its own set of challenges when it comes to making any changes to your loan. While it may be provided by a dealer under their brand name, the actual financier is often anonymous. This can make it challenging to negotiate with the lender for term extensions, partial releases of security, or other structural changes to the loan. It is important to carefully evaluate the pros and cons of supplier-based financing in order to determine whether it is the right fit for your business. Another factor to consider is whether you are comfortable sharing your business financial information with an equipment dealer or supplier.

Are you interested in running a cost comparison?

For more information on all your options when you're offered a special rate, contact a Finance New Zealand adviser near you.

Similar Posts

12 January 2026

Asset & Equipment Finance LVRs

Purchasing new vehicles, machinery, or equipment often raises one key question: how much deposit is required? The answer depends on more than just the asset. It comes down to LVRs (Loan to Value Ratio's), structure, and lender, policy & appetite. This article explains how asset and equipment finance LVRs work in New Zealand, and why advice matters.

27 November 2025

The Bottom of the Cycle? What the OCR Cut Means for 2026

Shifting interest rates are reshaping the way businesses finance equipment, vehicles and growth. Understanding these changes can help you make smarter, better-timed funding decisions.

Page Links

Contact us

Finance New Zealand Limited L11 BDO Tower, 19-21 Como Street, Takapuna, Auckland 0622 PO Box 65164, Mairangi Bay 0754 T: (09) 222 0320E: info@financenz.co.nzMember of

Proud Sponsors of Auckland Rescue Helicopter Trust

Copyright Finance New Zealand Ltd 2026